Insurance Advisor Success Coach

Meena Kothari

Successful Professional Financial Advisor

Born & brought up in North Lakhimpur, Assam, I did my CA (Inter) with a three year article ship in Chennai after doing my graduation in Commerce. I began my professional journey in the year 2009 at Max Life as an Advisor. My natural flair for communication has helped me establish business relations effortlessly & retain my clients. I have carved a niche for myself as

Well qualified and trained

Awards And Recognition

Social engagement

Top Insurance Advisor & Coach

WHY CHOOSE

3789

lives Change by Meena Khothari

50+

AWARDS

18

Working Years

18

Experience

Financial Advisor

How We Do

Step-1

Investment advice: Financial advisors offer advice on those investments that fit your style, goals, and risk tolerance and goals, developing an investing strategy and making adjustments as needed.

Step-2

Debt management: Financial advisors can create strategies to help you pay down your debt and avoid debt in the future.

Step-3

Budgeting: A financial advisor will provide tips and strategies to create a budget that helps you meet your goals in the short and the long term.

Step-4

The fourth step is to develop planning recommendations. As a result, the planner chooses one or more recommendations to maximize the outcome for addressing the client’s funding requirements.

Step-5

Saving for college: Part of a budgeting strategy may include strategies that help you pay for higher education.

Step -6

Retirement planning: Likewise, a financial advisor will create a saving plan crafted to your specific needs as you head into retirement.

Step-7

Estate planning: Financial advisors will create a plan and help you identify the people or organizations you want to receive your legacy after you die.

Step-8

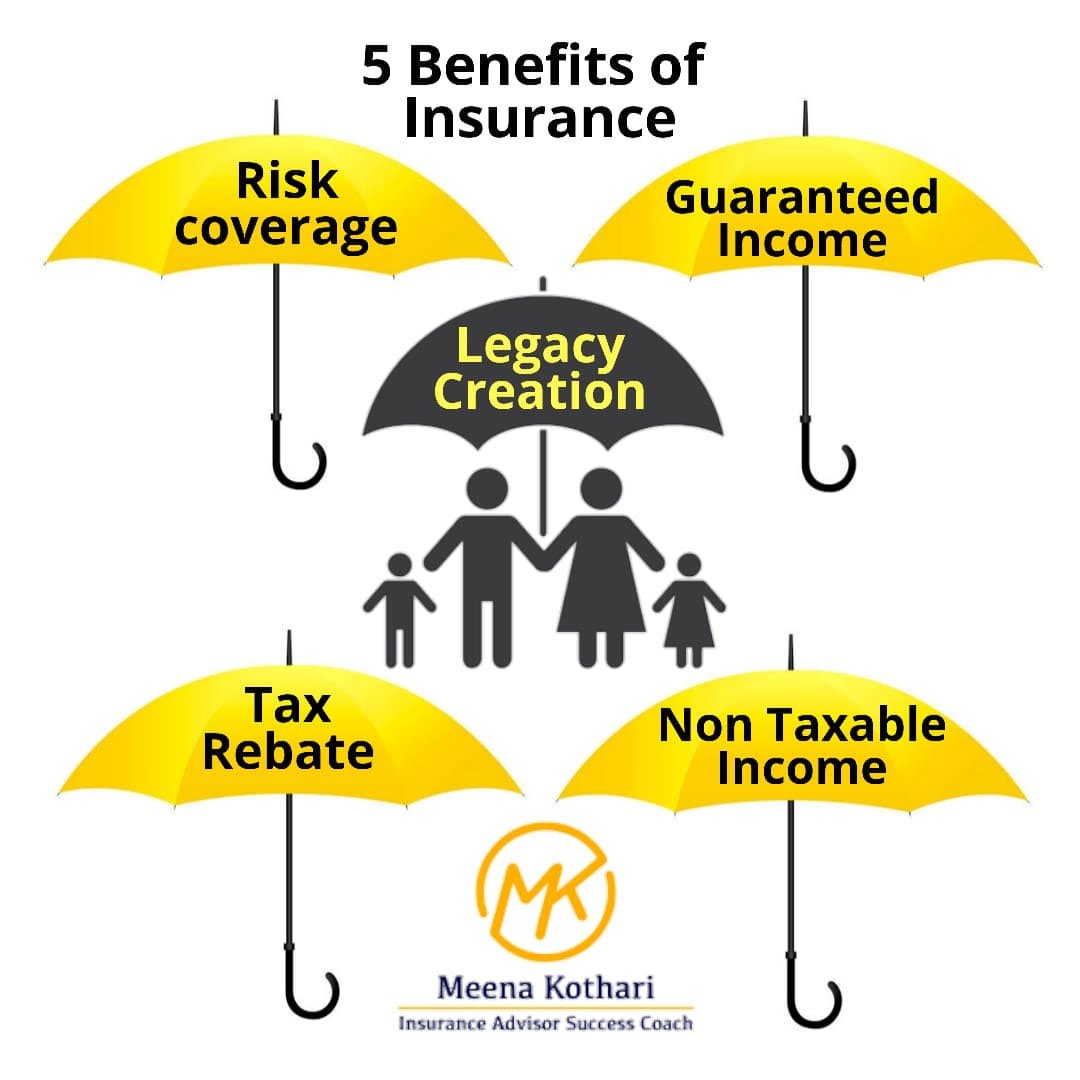

Long-term healthcare and insurance: A financial advisor will provide you with the best long-term solutions and insurance options that fit your budget.

Step -9

Tax planning: Tax return preparation, Maximizing tax deductions, Scheduling tax-loss harvesting security sales, usually around year-end, Ensuring the best use of the capital gains tax rates, Planning to minimize taxes in retirement.